Propmodo Daily

By Franco Faraudo · August 6, 2024

Greetings!

The government is cracking down on loan fraud, with Fannie Mae and Freddie Mac leading the effort. New regulations could reshape the lending industry and increase pressure on independent brokers. Meanwhile, New York City is set to become the first U.S. city to mandate EV chargers in parking garages. Plus, AI is driving new technologies that are streamlining real estate prospecting, though not always with positive results.

Now let’s dig in!

New Rules Could Make Multifamily Lenders Think Twice About Using Mortgage Brokers

The government is on the hunt for loan fraud. One strategy they are considering to combat this issue is changing the way government-backed entities, Fannie Mae and Freddie Mac, vet loans. The proposed changes, such as requiring lenders to independently verify financial information, could potentially slow down the loan generation process. These changes might also alter how lenders work with third-party independent brokers.

A recent Wall Street Journal article broke the news but offered few specifics about how these changes would be enforced. Fannie Mae and Freddie Mac have already started cracking down; both have stopped working with Meridian Capital while investigating reports of a broker falsifying documents. The threat of being banned from working with these entities is enough for most commercial lenders to implement any necessary changes.

Together, Fannie Mae and Freddie Mac own or guarantee around 40 percent of all multifamily lending. The increased scrutiny over lenders' roles in fraudulent loan transactions has already put some on the defensive. The WSJ article also reported that Berkadia had already pulled back on some of its business conducted through brokers.

New regulations around loan verifications will undoubtedly come with penalties for lenders who don’t follow protocol. These regulations could also make lenders liable for the actions of other parties involved in a transaction, such as brokers. Limiting this kind of liability is likely one of the reasons behind Berkadia’s decision. If the new rules are rolled out this year, lenders might begin re-evaluating the risk versus reward of using third-party brokers, which could be a significant blow to the large number of independent brokers currently working in the industry.

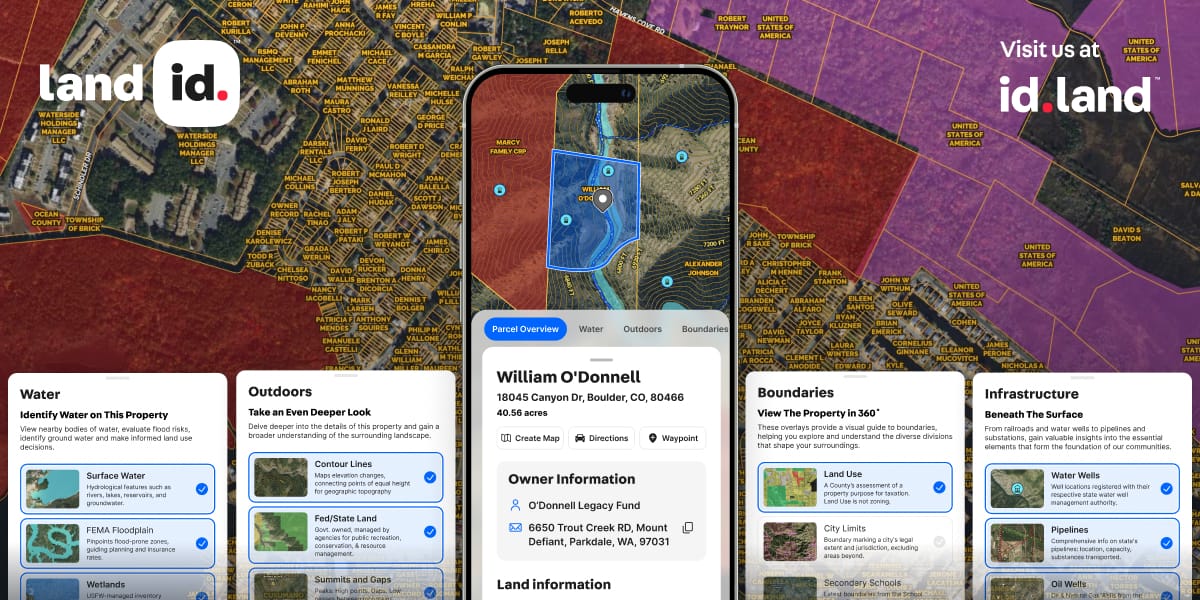

The Real Estate Professional’s Secret Weapon - Land id™

Discover extensive nationwide private parcel data, create & showcase powerful, shareable, interactive maps of any property: Fast, Easy and Mobile, with Land id™.

With the brand new streamlined Property Info Cards, Land id™ brings industry leading data and contextual layers to the forefront in a single tap or swipe.

Insider Insights

Reluctantly returning

A new survey of workers in the UK shows that 41 percent of them never work from home while only 15 percent would prefer it that way.

Battle over bonds

Two economists and former treasury advisors have accused the Fed of manipulating financial conditions in the economy by increasing the amount of short-term treasury bonds it sells to the financial market.

Spotlight

New York City is poised to be the first city in the country to mandate EV chargers in parking garages. As electric vehicle adoption grows nationwide, property owners will need to be prepared for more EV charging requirements.

Propmodo Technology

Artificial intelligence is powering new technologies that are streamlining and improving real estate prospecting. While these technologies have enormous benefits, real estate brokers need to be aware of many legal pitfalls.

Check out this week’s Propmodo Technology focus on Lending with the support of our friends at StackSource.

Headlines

August 3, 2024 | Business Insider

Real Estate Values in Texas and Florida Are Being Hit by Violent Weather as Insurance Costs Spike

August 2, 2024 | New York Post

Huge Midtown Office Building Sells at Auction for a 97% Discount After Receiving Just 1 Bid

August 5, 2024 | Arch Daily

Building Better with Data: The Role of Material Libraries in Sustainable Architecture

Overheard

Are You Enjoying This Newsletter?

Propmodo Daily is written and edited by Franco Faraudo with contributions from readers like you and the Propmodo team.

📧 Forward it to a friend and suggest they check it out.

🔗 Share a link to this post on social media.

🗣 Have ideas for future topics (or just want to say hello)? Share your feedback and tips at [email protected] or connect with us on X through @propmodo.

✅ Not subscribed yet? Sign up for this newsletter here.

📫 Please add our newsletter email, [email protected], to your contacts to make sure you don’t miss any updates.

Explore Propmodo

Read exclusive articles about a variety of topics, including Real Estate, Workplace, Buildings, and Development.

Browse our collection of interactive Propmodo Research e-books.

Sign up for upcoming Propmodo Live Webinars or watch past Propmodo Live videos on-demand.

Dive into Propmodo Technology articles, podcasts, and short videos about the future of commercial real estate.

Enjoy reading about trends and innovation in commercial real estate? Subscribe to Propmodo.com for unrestricted access to reliable, data-driven journalism and exclusive insights available only to subscribers.